Lifetime Balanced Fund

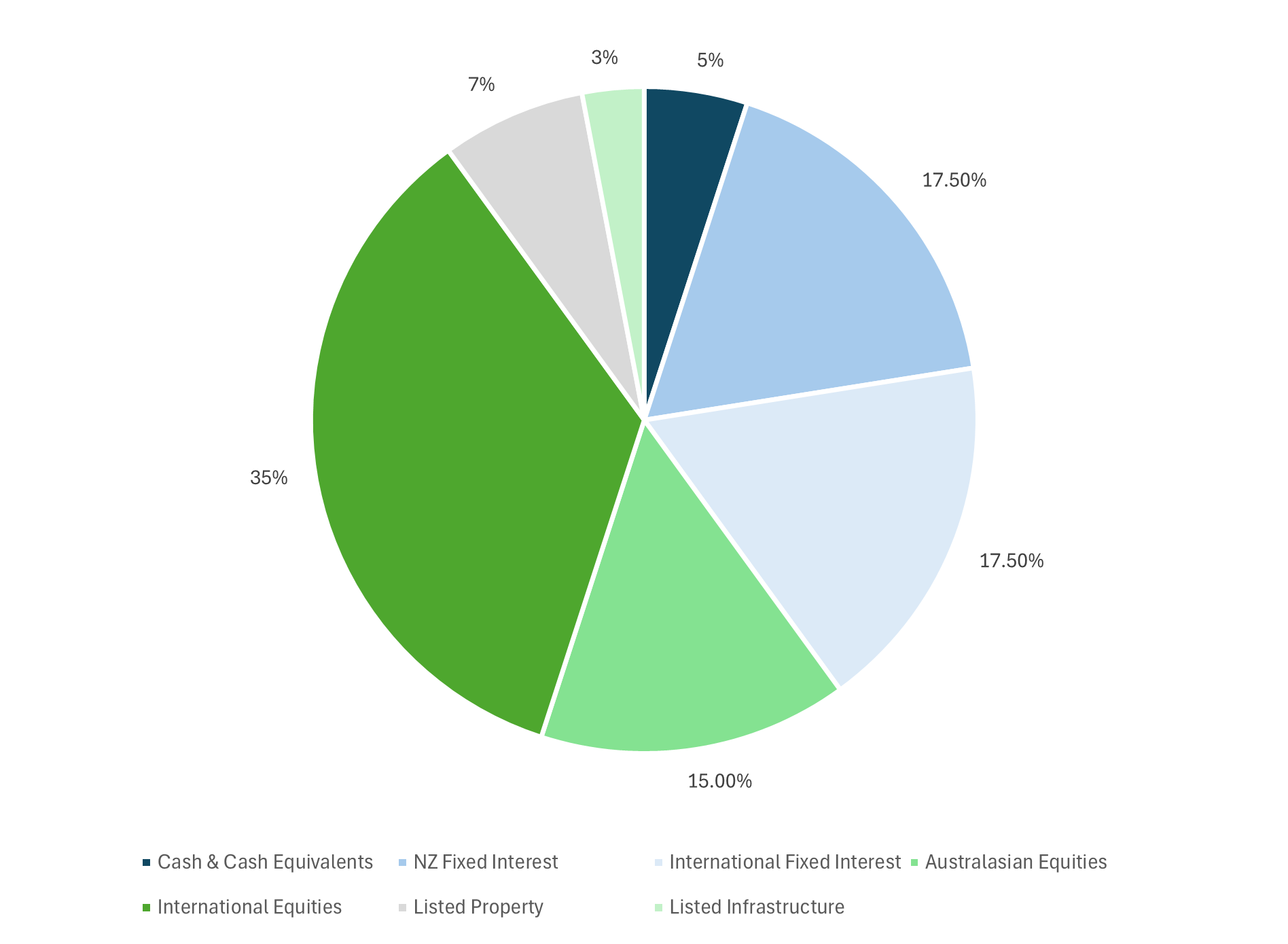

The Lifetime Balanced Fund is a diversified fund that provides exposure to a range of asset classes. It employs an active asset allocation strategy invested 40% in income assets (Cash & Cash Equivalents, NZ Fixed Interest, & International Fixed Interest), and 60% in growth assets (Listed Property, Listed Infrastructure, Australasian Equities, & International Equities). It is expected to experience medium to high volatility.

Investment Objectives

The fund seeks to track composite indices (before annual fund charge and tax), comprising:

-

-

- 5% - S&P/NZX Bank Bills 90-Day Index

- 17.5% - Bloomberg NZBond Composite 0+ Yr Index

- 17.5% - Bloomberg MSCI Global Aggregate SRI Select ex-Fossil Fuels Index, 100% hedged to NZD

- 10.5% - Morningstar New Zealand (total return) Index, including imputation credits

- 4.5% - S&P/ASX 200 Fossil Fuel Screened Total Return Index in NZD

- 17.5% - MSCI World Index NR ex NZ, Tobacco, Controversial and Nuclear Weapons

- 17.5% - MSCI World Index NR ex NZ, Tobacco, Controversial and Nuclear Weapons, 100% hedged to NZD

- 4% - S&P/NZX Real Estate Select Index

- 3% - Dow Jones Global Select ESG Tilted RESI, 100% hedged to NZD

- 3% - Dow Jones Brookfield Global Infrastructure Index, 100% hedged to NZD

-

Underlying Managers & Target Asset Allocations

The table below sets out the target asset allocation and underlying investment managers for the Fund.

For more information you can access the Funds Statement of Investment Objectives and Policy (SIPO).

|

Asset Class |

Underlying Fund Managers |

Investment Managers |

Product Name |

Benchmark Asset Allocation |

|

Cash & Cash Equivalents |

Fisher |

Fisher |

Fisher Institutional New Zealand Cash Fund |

5% |

|

NZ Fixed Interest |

Fisher |

Fisher |

Fisher Institutional New Zealand Fixed Interest Fund |

17.5% |

|

International Fixed Interest |

Mercer |

UBS |

Mercer Responsible Hedged Global Fixed Interest Index Fund |

17.5% |

|

NZ Equities |

Simplicity |

Simplicity |

Simplicity NZ Share Fund |

10.5% |

|

Australian Equities |

Smartshares |

Smartshares |

Smart Wholesale Australian Equity ESG Fund |

4.5% |

|

International Equities |

Mercer |

Legal & General |

Mercer Socially Responsible Overseas Shares Index Portfolio (Hedged & Unhedged) |

35% |

|

NZ Listed Property |

Kernel |

Kernel |

Kernel NZ Commercial Property Fund |

4% |

|

International Listed Property |

Kernel |

Kernel |

Kernel Global Property (NZD Hedged) Fund |

3% |

|

International Listed Infrastructure |

Kernel |

Kernel |

Kernel Global Infrastructure (NZD Hedged) Fund |

3% |

Lifetime Balanced Fund - Target Investment Mix

Fund Performance

Find below the performance to 31 December 2025. The returns are after tax (at 28%) & after fund charges, and before tax & after fund charges. Fund charges exclude administration charges, and advisor service fees (if applicable)

|

PIR Tax Rate |

1-Month |

3-Month |

6-Month |

12-Month |

3-Years* |

5-Years* |

|

After tax & fees |

0.04% | 1.03% | 7.42% | 9.27% | 10.58% | 4.53% |

|

Before tax & after fees |

0.09% | 1.21% | 8.07% | 10.60% | 11.96% | 4.94% |

* Returns over 1-year are annualised

The ‘AMP Balanced Fund’ was renamed the ‘Lifetime Balanced Fund’ when Lifetime Asset Management acquired the Scheme on 1 March 2023. Performance therefore reflects the ‘AMP Balanced Fund’ prior to 1 March 2023.